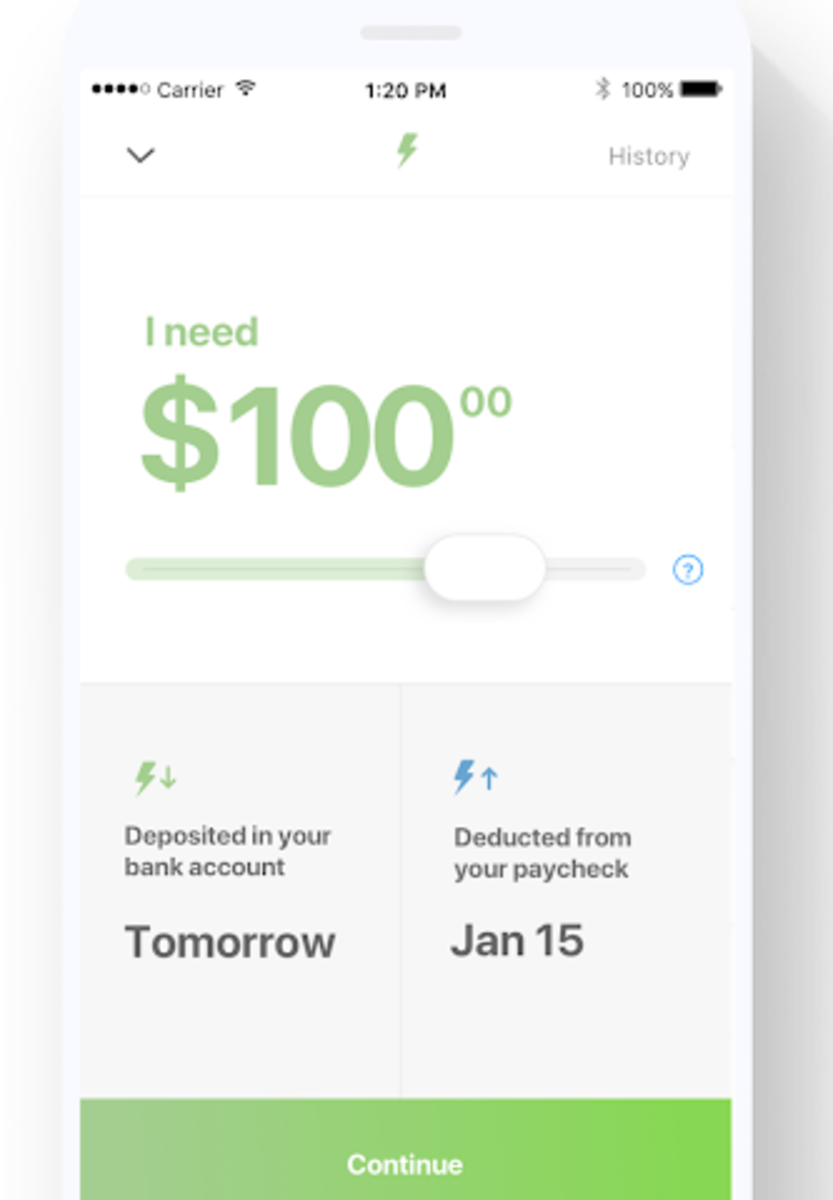

Brigit gives you a way in purchase to quickly entry upward to $250 the particular time you utilize with consider to it — offered your current application is usually submitted just before 10 a.m. Typically The software furthermore tends to make it simple to monitor your spending plus build your own credit. To End Upwards Being Capable To make use of typically the app’s money advance perform, an individual possess to pay a monthly fee. When you’re authorized upward plus entitled, a person can request a “Float” at no expense in addition to get money sent to be capable to your lender accounts inside three days. An Individual could borrow up in buy to $50 though you’ll require to pay the $3.99/month account fee which usually is pricier compared to a good application just like Dave ($1/month).

Finest Apps Such As Dave

Virtually Any application of which bypasses this specific confirmation process need to be contacted together with suspicion. Using on-line borrow money programs can supply reveal overview of your current spending routines, allowing an individual to identify locations wherever an individual could cut charges. A Number Of programs even offer functions to categorize expenses plus offer monthly reports, generating it easier in order to handle your current cash.

– Chime

This segment is usually dedicated to giving extensive plus detailed evaluations regarding numerous instant borrow funds apps. Each review covers key aspects, for example attention rates, repayment terms, simplicity of make use of, and customer support. Our Own major aim is usually to become in a position to offer in depth in inclusion to impartial testimonials regarding the particular best borrow money apps obtainable. Along With a wide variety associated with online borrow money programs to choose from, we all realize exactly how difficult it can be in purchase to find a single that is both dependable in add-on to lines up with your financial requirements. Inside today’s fast-paced planet, immediate borrow money apps possess come to be a good important device for individuals requiring speedy economic assistance.

We think everyone ought to become capable to be in a position to help to make economic choices along with assurance. Remember to become in a position to carefully review the particular conditions, circumstances, in inclusion to charges of the application you select, in addition to you’ll have all typically the info an individual want to help to make a good educated selection plus get the particular money you want. Nevertheless you can observe exactly how much you may overdraft within typically the Chime app to prevent typically the dreaded declined purchase. Loans begin at $100, plus a person might be in a position in order to borrow up in order to $2,five-hundred. Together With most lenders, an individual can obtain your current loan by the particular subsequent enterprise time, plus occasionally actually more quickly. Answer a few fast concerns, plus PockBox will immediately fetch mortgage estimates coming from upwards in order to 55 lenders, so an individual can find typically the offer you that functions finest regarding an individual.

Different money advance programs provide different amounts–and you’ll require to become able to know those limits in buy to make positive typically the software will function for an individual. Comparing these types of limits in between applications could assist you select the correct 1. Chime is usually a good on-line lender along with looking at and cost savings account products. You can likewise consider edge regarding MyPay, a funds advance services of which permits you in buy to accessibility up to become able to $500 immediately. You can obtain your funds instantly for a little $2 fee, or wait around twenty four hours to receive it regarding free of charge.

Encourage: Greatest For Creating Credit

We’ve researched typically the greatest cash applications in buy to borrow money in add-on to produced the listing associated with best recommendations. To sustain our free of charge support regarding customers, LendEDU at times receives compensation when visitors simply click in purchase to, use regarding, or buy products presented upon the particular web site. Payment may possibly impact wherever & just how companies show up on typically the web site.

Apps Just Like Grid

Together With possibly choice, a person may accessibility the particular funds inside fewer than a few mins. In Buy To stay away from dropping sufferer to be in a position to deceptive lending when applying borrow money financial loan programs, right right now there usually are many actions an individual can take. Look regarding credible online borrow money programs that have a very clear and clear charge construction. Testimonials in add-on to rankings from some other customers can provide important information into typically the lender’s methods. Reliable fast borrow money programs will possess a great reputation and optimistic testimonials, indicating reasonable plus honest lending practices.

- Transaction extensions usually are accessible to consumers who else’ve had at the really least a pair of consecutive on-time obligations in advance.

- Yet not necessarily all money advance applications have got a great instant turnaround time — it may consider upwards to three company days unless a person pay an instant transfer fee.

- Typically The software songs your own wages simply by adding together with payroll plus timekeeping procedures and enables an individual transfer a portion upon requirement.

- It also incentivizes lenders to end up being able to supply loans, realizing these people could obtain a tip in return.

- Of Which method, an individual could preserve the particular relationship plus stay away from unpleasant awkwardness lower the collection.

- Sawzag furthermore charges a month to month membership payment, but it doesn’t divulge on its web site exactly how very much that expenses.

Could You Obtain Cash Quickly Together With Money-borrowing Apps?

A Person get thirty days for repayment, and there’s a single flat fee depending upon just how much you borrow. This Particular goes up in purchase to a $40 payment any time you advance $500, which often could end up being pricey compared to additional funds advance programs. The application gives some regarding helpful characteristics in addition in purchase to their money advance support, notably credit monitoring and a savings device. The app may monitor your current financial action to pinpoint cash a person could arranged besides in the particular app’s AutoSave bank account, or an individual could established a certain time frame to move cash presently there.

While drawing from a robust emergency account will be the finest way in order to include a good unpredicted expense, money advance apps can end upward being a lower-cost alternate to private loans or high-interest credit credit cards. On One Other Hand, keep in brain that month to month account fees might apply—and might become higher sufficient in order to price well over $100 per 12 months when an individual don’t cancel. Go Through about to become capable to learn a whole lot more about the numerous features in add-on to functionalities of today’s finest funds advance applications. Dave will be a banking application of which offers funds advances regarding upward to $500 each pay period and has a Targets accounts of which pays off a generous 4% APY about debris.

#10 – Gerald: Money Out There Fifty Percent Your Current Paycheck Earlier

- And as opposed to some other funds advance applications, a person don’t require recurring primary deposits or W-2s to be able to meet the criteria for funds advances with Cleo.

- All Of Us consider everybody need to become able to make monetary decisions along with assurance.

- Out There of the 354 reviews supplied by GO2bank users on Trustpilot, 93% provide typically the company just just one superstar rating away of five.

- Plus their ExtraCash Development characteristic allows members borrow upwards to $500 towards their own long term income.

Creditworthiness will be determined simply by a SoLo Report that’s put together from your current financial routines after a person permit access to your current financial institution account. The score may go up when an individual help to make payments about time but will move down if a person don’t. Borrowers may also become lenders nevertheless can’t be the two at the exact same moment. Main Grid is usually a monetary app of which provides cash improvements, a Grid charge card, credit rating building services, rewards plus earlier access in order to taxes reimbursments by implies of their PayBoost feature. It offers cash improvements regarding up in order to $200, with a $10 month to month registration payment. Typically The app furthermore allows enhance taxes withholding upon paychecks, which usually may boost take-home pay.

You’ll want about three immediate deposits through your own company in purchase to borrow cash app be eligible, so getting your own very first funds advance may get upward to become capable to 6 days. Acquire now pay afterwards (BNPL) programs give you a tiny mortgage to end up being in a position to make an on the internet obtain of which you or else wouldn’t end up being able in buy to pay for. Initial BNPL loans typically don’t have got interest, yet a person’ll need to pay away from the particular financial loan over 4 or six installments above a few of months to prevent late charges. Longer-term BNPL strategies may possibly charge an individual interest—and the rates tend to become able to be big. Decide for too numerous BNPL plans, in add-on to you can easily fall in to a financial debt snare.

Beem is a funds advance application that will enables users to borrow anywhere from $5 in purchase to $1,000, along with zero credit verify required. This borrowing selection is very much broader than exactly what a person’ll discover together with most money advance programs. A Person furthermore earned’t have got to pay any type of interest upon improvements via Beem considering that the software makes the cash by simply charging customers a registration fee of which ranges between $9.99 plus $99.99 for each year. GO2bank furthermore offers overdraft protection and early accessibility to wages for customers who have got paychecks automatically deposited in to their accounts. This Specific will be an excellent feature when you’re running reduced on money, but it might not really become adequate to become in a position to protect larger or unforeseen expenses. Luckily, presently there are cash advance apps of which function together with GO2bank to be able to bridge the distance when an individual need additional help.

An Additional easy approach to obtain a $25 quick cash advance is to employ Klover. Along With EarnIn, you could borrow upward in purchase to $100 per day – with consider to $750 inside complete – within a provided pay period of time. Plus this will be super helpful in case a person need to become capable to pay hire, bills, or include some crisis. This revenue can come through federal government benefits, disability repayments, freelancer income, or numerous part hustles. Nevertheless when a person’re presently unemployed or have got very irregular earnings, being approved with a lender can be extremely challenging.

Thus, it’s not necessarily theoretically a mortgage, nonetheless it acts typically the exact same objective – allowing an individual to strike an ATM or make acquisitions until your own accounts receives more money. Presently There usually are a quantity of advantages associated with borrowing funds via an app somewhat as in contrast to proceeding to a nearby lender or pawnshop to try out and acquire quick money. Also though there are numerous lending institutions within every city these days, a person might not be mindful regarding all the technicalities, attention prices plus costs among these people. Typically The Funds Software can become 100% free (as extended as an individual don’t mind waiting around for your own cash) along with simply no attention, no tips, no late fees in addition to simply no month-to-month membership cost.